tax avoidance vs tax evasion philippines

Tax evasion vs Tax avoidance. Tax avoidance aka tax minimization is a way taxpayers minimize their taxes through legally permissible means meaning it is not punishable by law.

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Posted by 5 months ago.

. Tax July 1 2022 arnold. Tax avoidance uses lawful methods found in the tax code to cut your total tax liability. Tax evasion is the use of illegal means to avoid paying your taxes.

Tax July 1 2022 arnold. Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the. AX avoidance and tax.

Tax avoidance is the use of tax-saving devices within the means sanctioned by law and where the taxpayer acts in good faith and at arms length. Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes. Abs paying less taxes than gma because of maximizing legal.

This is entirely different from tax evasion which is. Tax Avoidance Vs Tax Evasion Philippines. To start with tax avoidance.

Tax avoidance is the use of tax-saving. Delaying or postponing the sale of a. Tax evasion on the other hand.

In tax avoidance you structure your affairs to. The difference between tax avoidance and tax evasion boils down to the element of concealing. This is entirely different from tax evasion which is.

The expressions tax avoidance and tax evasion are regularly utilized conversely yet they are totally different ideas. What is Tax Planning. Tax evasion is a felony.

At its core it requires deliberately structuring your assets in such a way that you pay as little tax as. Important Tax-related Documents You Need to Keep. There are currently 31 Philippine tax.

8 Best Practices for Lowering Your Taxes in the Philippines. Essentially tax avoidance is lawful while tax evasion isnt. Tax Evasion refers to the adoption of illegal methods for reducing the liability of payment of taxes such as manipulation of business.

Tax Avoidance Vs Tax Evasion Philippines. Tax Avoidance Vs Tax Evasion Philippines. Tax evasion occurs when the taxpayer either evades assessment or evades payment.

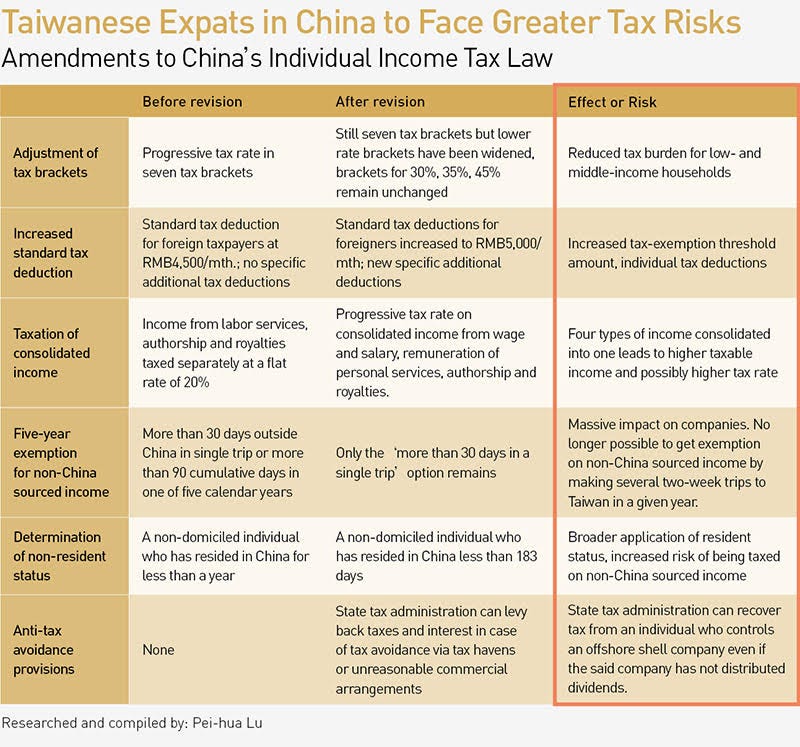

Tax avoidance and tax evasion are different methods people use to lower taxes. Tax evasion vs Tax avoidance. The Philippines has concluded several tax treaties to avoid double taxation and prevent tax evasion with respect to taxes on income.

Difference Between Tax Evasion and Tax Avoidance. Tax Evasion vs. Tax avoidance vs tax evasion 2021-11-18 - MORE TO FOLLOW MTF EUNEY MARIE MATA-PEREZ.

Tax Avoidance Vs Tax Evasion Philippines.

The Top 15 Tax Havens For Millionaires Around The World

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Concept Of Tax Evasion Tax Avoidance Definition And Differences

Philippines Tax Evasion Introduction By Big Tows322 Dphil Medium

Tax Evasion In The United States Wikipedia

Tax Perjury David Klasing Tax Law

China Cracks Down On Tax Evasion Chasing Every Penny By Commonwealth Magazine Commonwealth X Crossing Medium

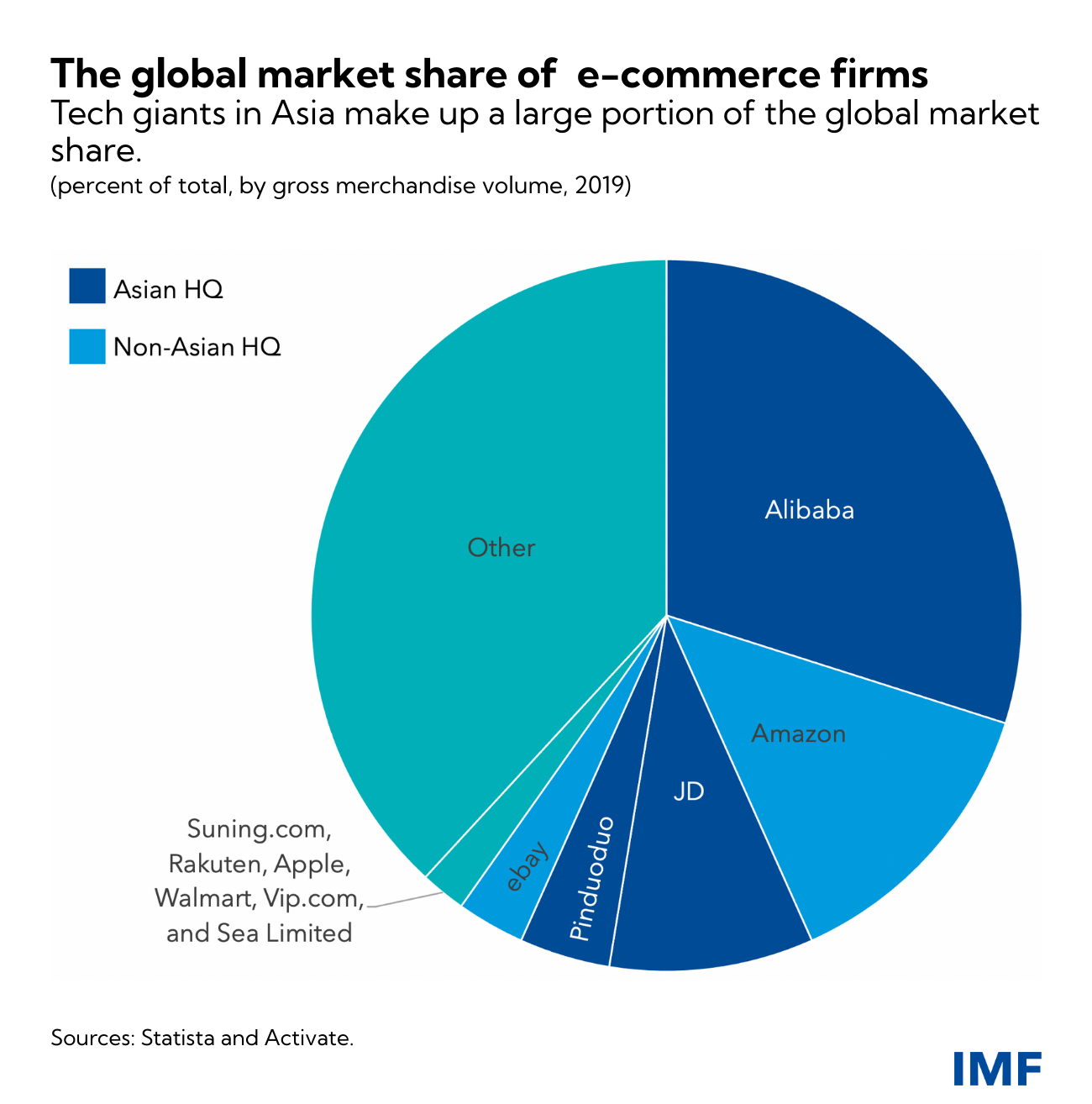

The True Cost Of Global Tax Havens Imf F D

Tax Evasion And Tax Avoidance Definitions Differences Nerdwallet

Philippine Taxation Evasion Or Avoidance Steemit

Here S How You Can Legally Reduce Your Taxes If You Own A Business Globe Mybusiness Academy

Some Of The Best Methods To Prevent Tax Evasion Enterslice

How To Tax In Asia S Digital Age

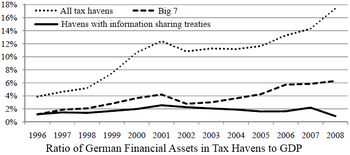

Estimating International Tax Evasion By Individuals

Irs Goes Undercover And The Movement Against Corp Tax Avoidance Htj Tax

Pdf Understanding And Measuring Tax Avoidance And Evasion A Methodological Guide